Five Steps for Effective Tech Implementation

New gadgets, apps and software platforms can be so exciting. They can also cripple your productivity and destroy employee morale. A leader’s reputation can be destroyed by rolling out impulsive changes. Proper implementation of new

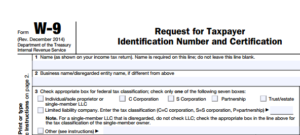

Now is a great time to do a W-9 audit!

Most people know they have to give independent contractors a 1099. Here are some other expenses eligible for a 1099: Interest paid on loans, rent, and household employees. A W-9 should be collected before paying these expenses.

Sick Leave Q&A

Q&A with Lindsay N. Malachowski, Attorney at Law. Are You Ready for Oregon’s New Sick Leave Law? Beginning January 1, 2016, most Oregon employers will be required to offer sick leave to employees. Who is affected?

A Vendor by a Different Name

I cover for clients from time to time. Birth, death, injuries and illnesses necessitate a contingency plan for the accounting department. I am that contingency plan for some clients. It is at these times that

Affordable Care Act and Your Taxes

We all lived through 4/15! Whoo hoo! Some of you may have filed extensions for your personal and/or business taxes. Others may have already received a refund or notice of tax due. Lauren Wingert CPA

![Get Organized!, LLC [GO!]](https://gogetorganized.com/wp-content/uploads/2016/05/logowithnamev2-2-225x63.png)