There are two ways to look at your accounting needs. The first is based on skill set. The second is based on roles in your company.

One: Skill Set

As Patrick Bonnaure, ProLedge Founder, says:

If its tax related, go to your CPA

If it’s day-to-day bookkeeping, go to your bookkeeper

If it’s too complicated for your bookkeeper, go to a QuickBooks Consultant.”

Understanding Your Relationship with Your Bookkeeper

Understanding Your Relationship with Your Bookkeeper

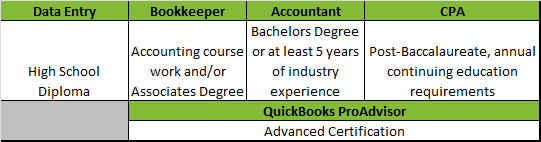

I have seen many companies pay dearly for dismissing the importance of a good bookkeeper. While most anyone can do data entry it takes training to be a bookkeeper. This training can come in the form of coursework or on-the-job.

You get what you pay for so balance paying low wages for your bookkeeping position with having accurate information. Having a data entry person sitting in the bookkeeping chair can cause large increases to your CPA bill unless you have other support such as an on-call Accountant.

While the majority of QuickBooks ProAdvisors are Accountants, some CPAs and Bookkeepers are also certified. It is important to understand the skill set of all the players. Is the person acting as your bookkeeper actually a data entry person and has limited understanding of accounting principles? If yes, a QuickBooks ProAdvisor Bookkeeper may provide the services your bookkeeper needs. Do you have a rock star bookkeeper? If yes, then he/she will best be served by a QuickBooks ProAdvisor that is an Accountant or CPA.

TWO: Roles in Your Company

The second way to look at your accounting needs is based on roles in your business:

Create

Bookkeeping is more than data entry. Your bookkeeper should understand how the data impacts Financial Reports and have the ability to reconcile accounts. Bookkeepers should also have a working knowledge of basic accounting controls and should not be able to sign checks or transfer money.

Review

This is a vital step and can be accomplished by a business owner with the time and accounting knowledge. Your Controller is responsible for ensuring Financial Reports are supported by adequate and accurate documentation and reflect a complete view of the company’s financial position.

Use

CFOs understand the ‘big picture’ of the company and use the financial data created to track goals, create projections, and work with banks and investors to maintain a healthily cash flow. CFOs provide guidance to business owners to help them use their resources to build net worth by investing internally or externally.

Understanding Your Relationship with Your CPA

Your Bookkeeper and/or Controller can help your CPA complete tax returns efficiently by providing concise and accurate information. Ensure you have a clear understanding with your CPA. What level of support are they providing?

I have seen many business owners assume that their CPA is acting as their Controller. This is a dangerous assumption and can cost the business lots of time and money to repair their accounting systems after chaos settles in.

Having an on-call Controller will ensure your books are accurate, provide your Bookkeeper with support, and reduce the hours your CPA has to spend on your accounting before it is ‘tax return ready.’

![Get Organized!, LLC [GO!]](https://gogetorganized.com/wp-content/uploads/2016/05/logowithnamev2-2-225x63.png)