I’m honored to present guest blogger David C. Bledsoe, CPA/PFS owner of Bledsoe Financial LLC. David helps people with moola planning and wealth building. He is very knowledgeable and is a top notch human being. I feel luck y to know him. As a fellow artist I fully support contributions to cultural organizations. Also notice that David “never been one to let the “tax tail wag the economic dog”” Take it away David!

We are rapidly approaching year end and the elves in Washington certainly have been busy – confusing the rest of us. My crystal ball is none too clear at the moment but I think it goes without saying that our collective “tax burden” will rise next year. Whether this comes from an increase in tax rates or a decrease in deductions and credits (or some combination of the two) has yet to be played out. I have never been one to let the “tax tail wag the economic dog” but if there are issues or concerns that any of you would like to discuss, please contact me. There still is time to take positive action before year end. And remember to set aside those 12/31 statements for our annual updates and reviews.

As this is the time of year when many of you are contemplating charitable gifts, I thought I would put in a plug for the Oregon Cultural Trust. (Non-Oregon residents can skip ahead!)

As a former musician, I like to support the arts and have been a longtime contributor to various arts organizations. With the advent of the Oregon Cultural Trust, it makes it so much easier to be charitable AND benefit those arts organizations that are important to us without such a significant impact on the pocketbook.

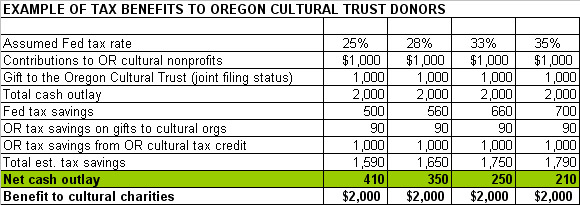

Let me explain how this works, assuming a husband and wife filing jointly. The state of Oregon allows a maximum credit of $1000 for contributions to the Cultural Trust. A matching contribution (or contributions totaling at least that same amount of $1000) is made to an Oregon cultural organization (a definitive listing of eligible organizations may be found on the state’s website). For federal tax purposes, one is allowed a deduction for the total amount contributed – in our example, $2000. Oregon allows a deduction for the $1000 contributed to the cultural organization(s).

In addition, Oregon allows a dollar-for-dollar credit for amounts contributed to the trust. The example below (copied from the state’s website) shows the result. Note that for joint filers in the 33% bracket, the total after-tax cash outlay for a $2000 contribution is just $250. It’s a very nice way to leverage charitable gifts to arts organizations in Oregon! For anyone interested in more information, check out their website at www.culturaltrust.org.

Please note that you don’t have to contribute the maximum to participate in the “leverage” potential. As long as it’s dollar-for-dollar between the trust and the arts organization(s), the tax effect applies.

Wishing you all the best this holiday season!

David

You can contact David at (541) 929-4949.

![Get Organized!, LLC [GO!]](https://gogetorganized.com/wp-content/uploads/2016/05/logowithnamev2-2-225x63.png)