- This event has passed.

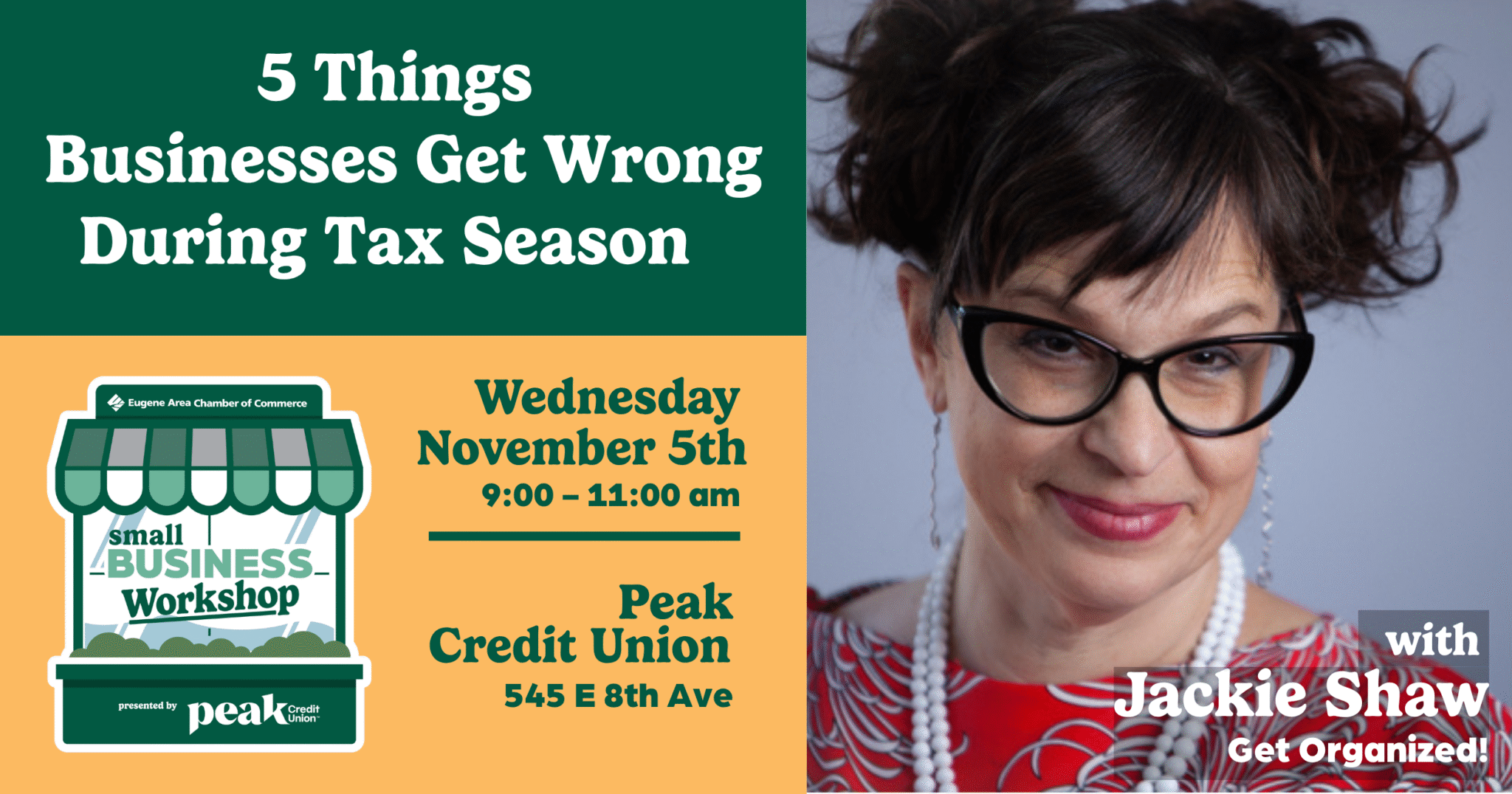

5 Things Businesses Get Wrong During Tax Season

We invite business owners and bookkeepers to join us for an entertaining and educational presentation that will teach you how to keep your relationship with your tax preparer in good standing and reduce tax season stress. Every year, small businesses make avoidable mistakes that frustrate their CPAs, slow down the tax prep process, and in some cases, even jeopardize the relationship with the tax preparer. With the huge shortage of accounting professionals in the U.S., what can you do to ensure tax season stops being such a scramble?

In this lively and practical session, Jackie Shaw will walk you through the five most common missteps business owners make, and how to avoid them.

You will learn how to:

- Prep your books before the year ends so you are not caught off guard in the spring

- Handle IRS rules (like W9 collection) the right way

- Avoid major bookkeeping errors that many small businesses are making

- Understand the unique nature of S-Corp officer benefits

- What Retained Earnings is and why it is important to keep it accurate

If you have ever felt stressed or unprepared when tax season rolls around, this session will give you simple, proactive steps to make 2025 your smoothest year yet (and keep your CPA happy along the way).

![Get Organized!, LLC [GO!]](https://gogetorganized.com/wp-content/uploads/2016/05/logowithnamev2-2-225x63.png)